From the desk of Michael Tomlin

In 2022 and into 2023, our regional governments will focus on risk management. In the insurance industry, insurers will be worried about climate change, hurricane frequency, and the threat of increasing hurricane intensity.

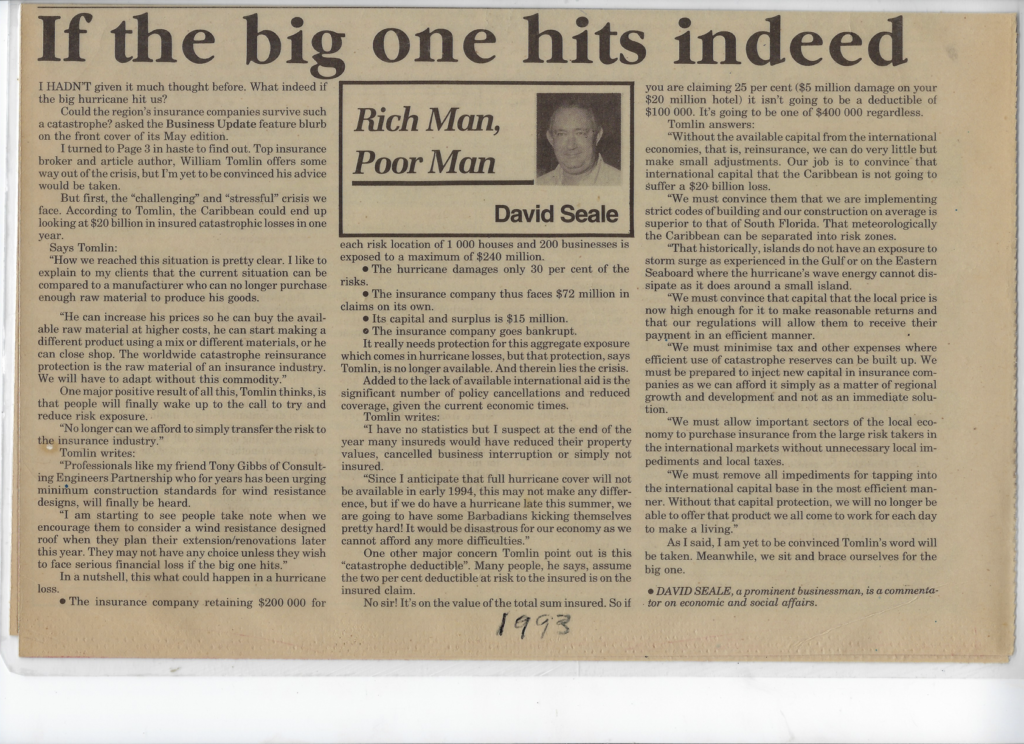

On June 13th, 1993, Sir David Seale wrote an article in The Nation News (see image below) commenting on a piece that William Tomlin wrote the previous month that same year. Both Seale and Tomlin address the large claims of Hurricane Andrew, which hit Florida in 1992 and was the costliest natural disaster in that decade in insurance payouts.

What is interesting (and somewhat sobering) is that William Tomlin’s comments in 1993 are applicable and valid in 2022, 29 years later. Their commentary highlights the ‘knock-on effect’ in 1993, where premiums increased significantly (100% increases in some cases), and there was the real threat of insurers and reinsurers pulling out of the Caribbean market or simply refusing to provide hurricane insurance. William Tomlin’s commentary in 1993 and Sir David Seale’s supporting article expertly argue that the region can no longer afford to purely transfer the risk to the insurance industry. Tomlin says, “We must convince [the industry] that we are implementing strict building codes and our construction on average superior to South Florida.”

Seale’s and Tomlin’s commentary is even more relevant today. Hurricane season 2022 has felt uncannily inactive, but we must still ask pertinent questions about organising resources to build resilient infrastructure against natural disasters and climate change as “we sit and brace ourselves for the big one.”

– MT

David Seale’s 1993 Response piece to William Tomlin’s article earlier that same year

Transcribed:

If the big one hits indeed

by DAVID SEALE, a prominent businessman, is a commentator on economic and social affairs.

Published in the Sunday Sun, Nation News, June 13th 1993

I hadn’t given it much thought before. What indeed if the big hurricane hit us?

Could the region’s insurance companies survive such a catastrophe? Asked the Business Update feature blurb on the front cover of its May edition.

I turned to Page 3 in haste to find out. Top insurance broker and article author William Tomlin offers some way out of the crisis, but I’m yet to be convinced his advice would be taken.

But first, the ‘challenging’ and ‘stressful’ crisis we face. According to Tomlin, the Caribbean could end up looking at $20 billion in insured catastrophic losses in one year.

William Tomlin

Says Tomlin:

“How we reach this situation is pretty clear. I like to explain to my clients that the current situation can be compared to a manufacturer who can no longer purchase enough raw material to produce his goods.

“He can increase his prices so he can buy the available raw material at higher costs, he can start making a different product using a mix or different materials, or he can close shop. The worldwide catastrophe reinsurance protection is the raw material of an insurance industry we will have to adapt without this commodity.”

One major positive result of all this, Tomlin thinks is that people will finally wake up to the call to try and reduce risk exposure.

“No longer can we afford to simply transfer the risk to the insurance industry.”

Tomlin writes:

“Professionals like my friend Tony Gibbs of Consulting Engineers Partnership who for years has been urging minimum construction standards for wind resistance designs will finally be heard.

“I am starting to see people take note when we encourage them to consider a wind resistance designed roof when they plan their extension/renovations later this year. They may not have any choice unless they wish to face serious financial loss if the big one hits.”

In a nutshell, this is what could happen in a hurricane loss.

- The insurance company retaining $200,000 for each risk location of 1000 houses and 200 businesses is exposed to a maximum of $240 million.

- The hurricane damages only 30% of the risks.

- The insurance company thus faces $72 million in claims on its own.

- Its capital and surplus is $15 million.

- The insurance company goes bankrupt.

It really needs protection for this aggregate exposure which comes in hurricane losses, but that protection, says Tomlin, is no longer available. And therein lies the crisis.

Added to the lack of available international aid is the significant number of policy cancellations and reduced coverage, given the current economic times.

Tomlin writes:

“I have no statistics but I suspect at the end of the year many insureds would have reduced their property values, cancelled business interruption or simply not insured.

“Since I anticipate that full hurricane cover will not be available in early 1994, this may not make any difference, but if we do have a hurricane late this summer, we are going to have some Barbadians kicking themselves pretty hard! It would be disastrous for our economy as we cannot afford anymore difficulties.”

One other major concern Tomlin points out is this ‘catastrophe deductible’. Many people, he says assume that the 2% deductible at risk to the insured is on the insured claim.

No Sir! It’s on the value of the total sum insured so if you are claiming 25% [5 million damage on your $20 million hotel] it isn’t going to be a deductible of $100,000. It’s going to be one of $400,000 regardless.

Tomlin answers:

“Without the available capital from the international economies, that is, reassurance, we can do very little but make small adjustments. our job is to convince that international capital that the Caribbean is not going to suffer a $20 billion loss.

“We must convince them that we are implementing strict codes of building and our construction on average is superior to that of South Florida. That meteorologically the Caribbean can be separated into risk zones.

“That historically, islands do not have an exposure to storm surge as experienced in the gulf or on the eastern seaboard where the Hurricanes wave energy cannot dissipate as it does around a small island.

“We must convince that capital that the local price is now high enough for it to make reasonable returns and that our regulations will allow them to receive their payment in an efficient manner.

“We must minimize tax and other expenses where efficient use of catastrophe reserves can be built up. We must be prepared to inject new capital in insurance companies as we can afford it simply as a matter of regional growth and development and not as an immediate solution.

“We must allow important sectors of the local economy to purchase insurance from large risk takers in the international markets without unnecessary local impediments and local taxes.

“We must remove all impediments for tapping into the international capital base in the most efficient manner. Without that capital protection, we will no longer be able to offer that product we all came to work for each day to make a living.”

As I said, I am yet to be convinced Tomlin’s word will be taken. Meanwhile, we sit and brace ourselves for the big one.

“If the big one hits indeed” by DAVID SEALE, a prominent businessman, is a commentator on economic and social affairs.

Published in the Sunday Sun, Nation News, June 13th 1993