At Tomlin Insurance Brokers, we specialise in commercial insurance. We know that no two companies are the same, and the types of coverage our clients need vary greatly. Using our experience, we have developed an approach that we take with each client – ensuring timely and effective management and critical response.

We are Tomlin Insurance Brokers

An independent commercial insurance broker with over 30 years experience in corporate insurance and risk management in the Caribbean.

WHY USE AN INSURANCE BROKER

We know the markets, legislation, and best practices

We use our expertise in commercial insurance and risk management and act on your behalf. We provide advice in the interest of our clients, leveraging our network of insurance providers to get you the best coverage at the best price.

What are the benefits of

using an Insurance Broker?

We are proud of our independence – We do not have the pressures of working with a parent company or partner broker who might not necessarily have the expertise needed for our clients.

By being independent, our success is based only on exceeding our client’s expectations. We have the freedom to work for our clients securing the best terms, conditions, expertise, and coverage.

What makes us

stand out

Clients trust us.

We are there to help you to make the tough decisions and negotiate any claims. We are not afraid to have difficult conversations with insurance companies that may pose a problem with claims.

We are here to advise, assist and support you.

What do we

stand for?

We:

– Do what’s right always

– Engage a client-focused strategy

– Ask questions every day

– Provide solutions to the client and insurer.

– Work hard & play hard. Work-life balance, especially family, is important to our team.

Why do we concentrate on

commercial business?

Large, complex risks are our specialty.

We add value to large businesses in coverage, identifying and managing the various risks, providing self- insurance options, helping with claims, and finding that specialized market to write the business.

the tomlin approach

- Gather information, assessing your unique risk profile and insurance needs.

- Research your industry while staying current with changes in the insurance industry, especially in the Caribbean.

- Negotiate the best policies at the best price after collating the various policies offered by insurance providers.

- Make sure that you understand the terms, extent and risks associated with your coverage, and how to reduce the need to make a claim.

- Negotiate on your behalf and work closely with you in the event you need to make a claim.

COMMERCIAL

BUSINESS

Energy/Power

/Utilities

Professional Firms

(Lawyers, Doctors, Accountants)

Hotels, Hospitality

and Leisure

Real Estate and

Property Management

Marine & Aviation

Regional &

International Business

GOVERNMENT

ENTITIES

CONSTRUCTION

Our unique services

Beyond the customary offerings of an insurance broker, we have distinctive solutions tailored specifically for our clients.

Request more informationHotels, Resorts and Accommodations

Running luxury accommodations like hotels and villas demands a personalized insurance service. These businesses encounter various legal challenges from guests and staff. Many incidents leading to legal action aren’t covered by standard public liability policies or regional hotel programs. We’ve crafted a comprehensive liability policy, providing extensive coverage at competitive prices, specifically addressing the unique risks hotels face.

Risk Analysis

The Tomlin Team distinguishes itself from the standard broker insurance renewal cycle by delivering a thorough examination of the risks your business encounters. We go the extra mile by:

- Assessing your current risks and comparing them with your existing premiums

- Evaluating and elucidating the potential implications of new risks.

Residential Protection

As a commercial broker, we were able to use our experience and network to develop an improved homeowner’s policy compared to your average broker or insurance provider.

Group Health

Tomlin Brokers provides straightforward, responsive, and proactive group medical coverage services.

We prioritize understanding your needs and provide transparent renewal terms well in advance. Our regular performance reviews keep you informed. Plus, we’re advocates for preventive care, helping both employees and employers manage long-term health.

A few of the companies we love working with

Meet Your Team

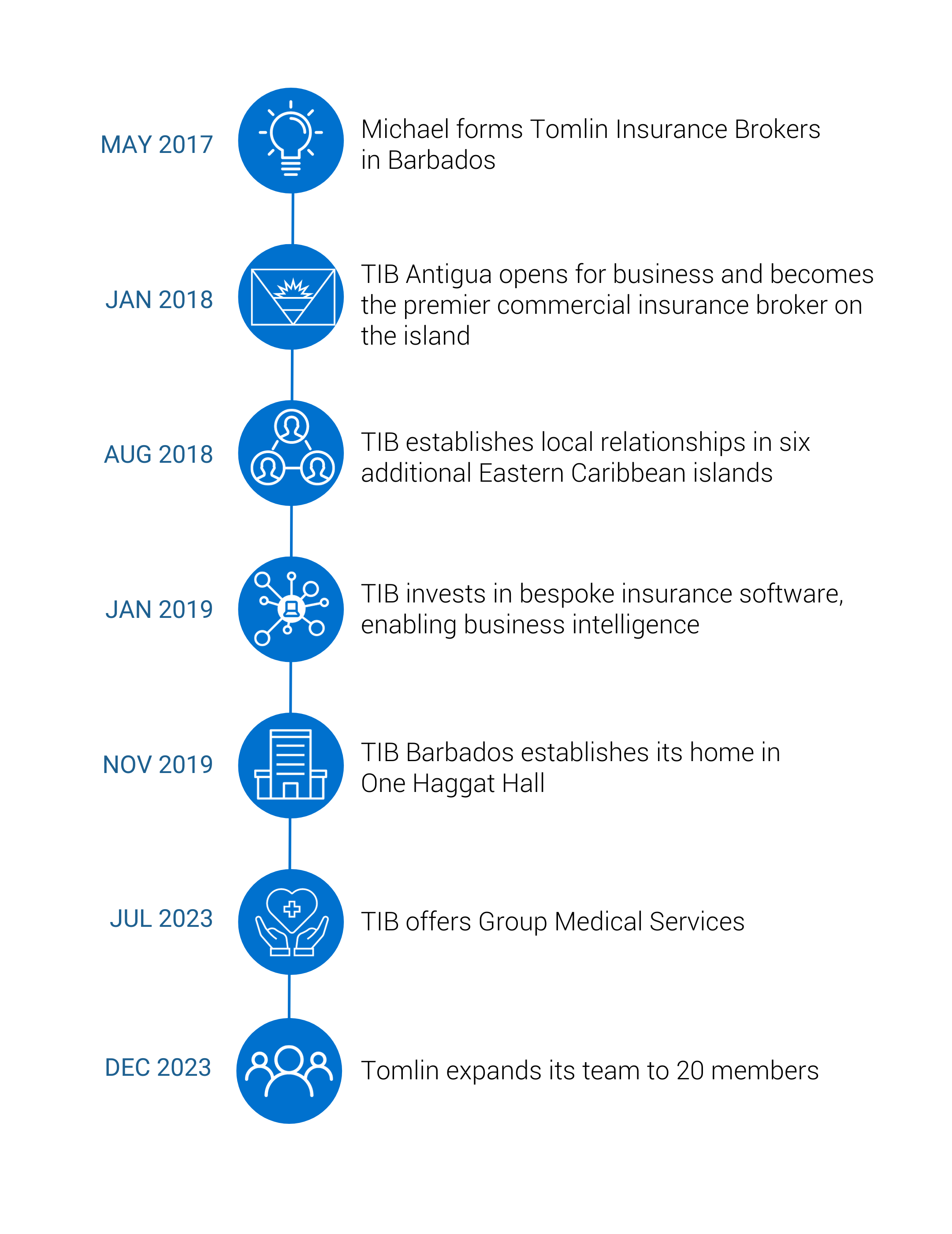

Michael founded Tomlin Insurance Brokers in Barbados and Antigua in 2017. Michael has over 20 years of experience in the insurance industry, beginning at AON in Toronto, Canada, and then at a Caribbean brokerage as a senior management executive. He recognized the opportunity to build a regional business, focusing on insurance solutions and services for Caribbean commercial clients.

Michael has an MBA from the University of Durham and received his Chartered Insurance Professional designation from Canada.

He is one of the most technically competent insurance professionals and risk analysts in the region and has strong skills in representing clients and negotiating large claims within the Caribbean.

He sits on the Boards of many of the large Captive Insurance companies domiciled in Barbados.

As Claims Manager, his familiarity with the insurer’s policy wordings, and understanding of technical insurance issues ensure a smooth and hassle free claims experience for Tomlin Insurance Brokers’ clients.

With Andrew, you have a open channel of communication and a dedicated representative to discuss any issues with the relevant parties, answer any technical questions, and negotiate with the insurer on your behalf.

Ashley values providing exemplary service and ensures she brings her positive attitude to the Tomlin team.

Our Antigua Team

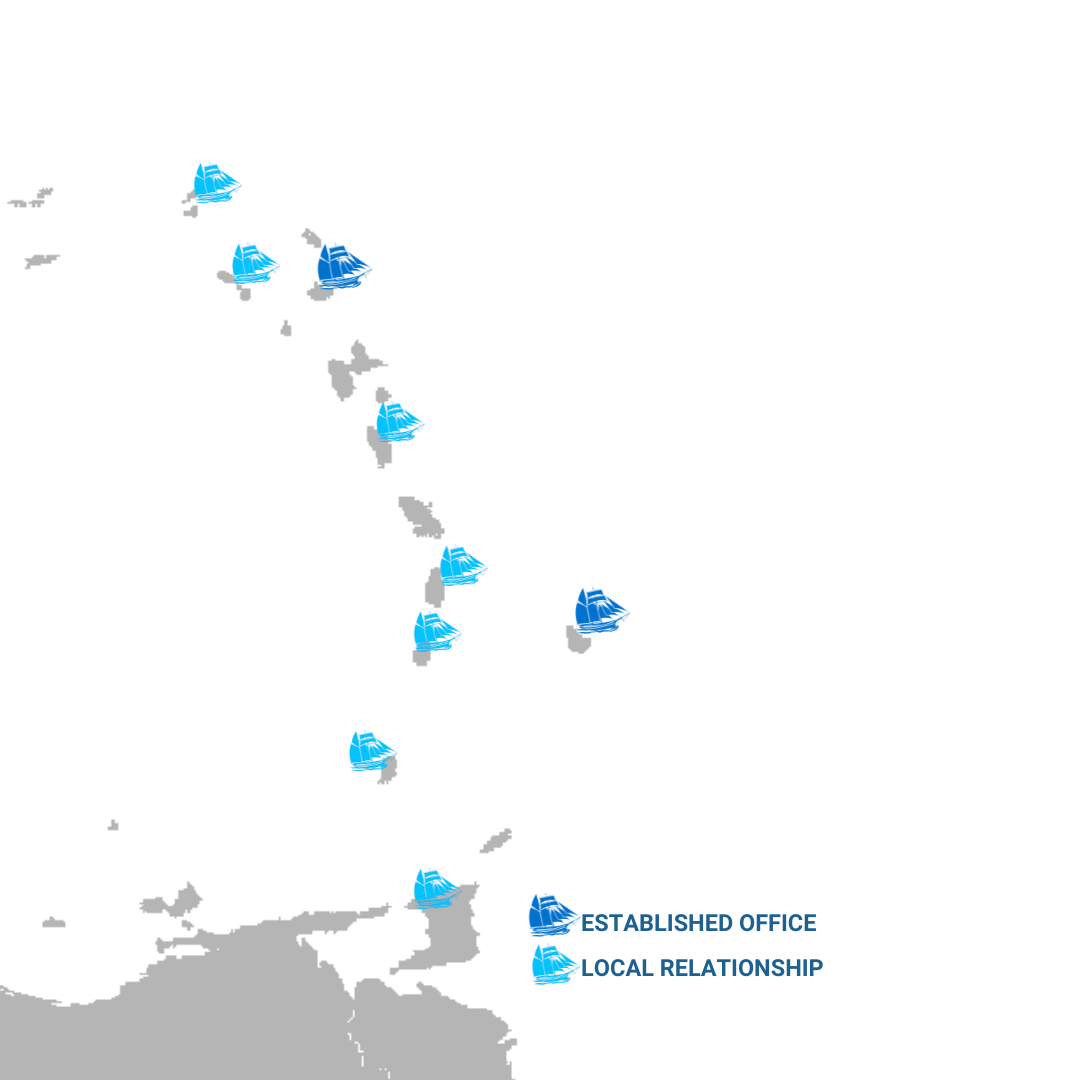

Our Network

Tomlin Offices in:

- Antigua and Barbuda

- Barbados

Local Relationships established in:

- Grenada

- St Lucia

- St Vincent

- Dominica

- St Kitts

- Anguilla

- Trinidad