From the Ground Up: Insuring Construction Sites for Owners, Developers and Contractors

We want you to Maximize Your Success on a Construction Project by Mitigating Insurance Risks Every Step of the Way

by William Tomlin

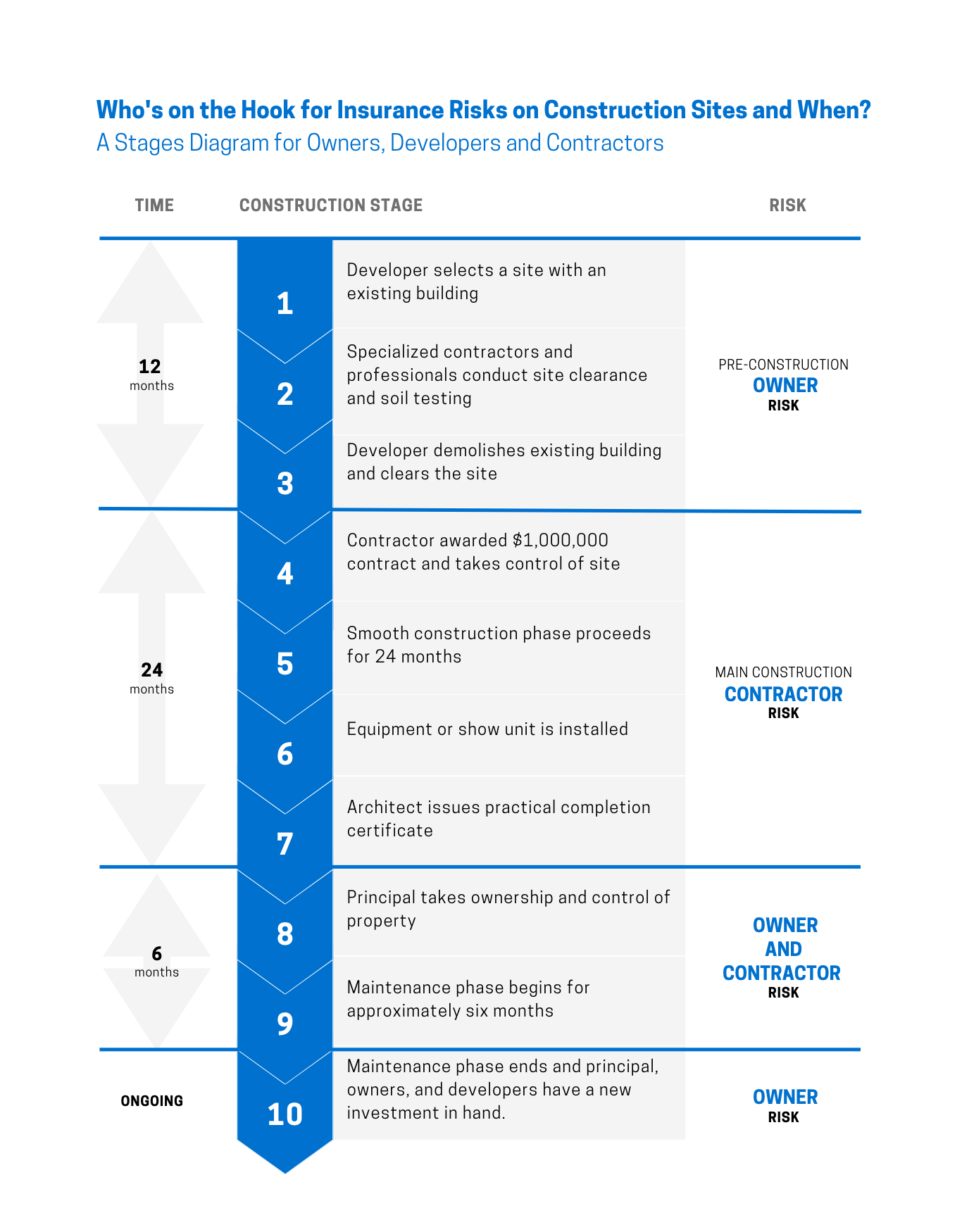

To ensure proper coverage for construction projects, it’s crucial to understand all the stages of the project and the risks associated with each one. Proposed sites with an existing structure, in particular, can pose distinct and complex risks that require different types of insurance or arrangements. By considering each stage and its potential risks, our clients can be better equipped to protect themselves and their project from unforeseen setbacks.

Our infographic below provides a visual representation of the typical stages involved in a construction project, along with an overview of who carries the insurance risk throughout each phase.

This description is for a new project and not a renovation or extension to an existing building.

STAGE ONE: The Undeveloped Project Site

The Developer (or is sometimes called the Principal) owns the site. Let’s assume there is an existing building on the land to be demolished.

The Risks:

It is a common misconception that insurance is not necessary at this stage as there are no apparent risks. However, risks such as trespassing and accidents on the site, including accidents associated with unprotected wells or unstable buildings, can occur, and the Owner will still be held responsible under Common Law. To mitigate this risk, a simple premises public liability policy can provide adequate protection, and the premium is generally minimal.

Additionally, if the building is to be demolished, the Principal needs to understand that even if the building is insured against fire, storm, and other damages before demolition, the Insurance Company will not pay for the cost of the damages. While it is a judgment decision by the Principal, it is important to be aware of this fact as the Principal has not suffered a financial loss since the building was to be demolished anyway. Understanding the potential risks and necessary insurance coverage can help protect the Developer’s interests and ensure a successful project.

STAGE TWO

This stage is the site clearance, surveying, and demolition of the building.

This time gap between doing this preliminary work and handing over the site to the Main Contractor can create serious risk issues for the Principal. Many do not arrange any insurance during this period and assume wrongly that their existing Insurance, such as Public Liability, will operate.

The Risks

The key exposure is liability, especially with the demolition activity. Quite often, a standard liability policy is presented as evidence of Insurance, but that will not cover any injuries or damage to neighboring property from the demolition. A specialist liability cover is required for the demolition.

STAGE THREE

The main Contractor has been selected, and a Building Contract has been issued. A contractor is instructed to take control of the site and commence works.

From this point on, any risk and insurance issues will be ultimately determined by the Contract Wording prepared by the Professionals advising the Principal. Still, the standard approach is to place the responsibility for risk and Insurance on the Contractor.

All the Insurance policies issued must reflect the conditions specified in the Contract. Unfortunately, our experience is that this is often neglected, and the insurance and contract intent vary, and there are significant challenges.

The Risks

The responsibility for insurable risks on a construction site shifts to the Contractor from the contract award date. They must arrange appropriate insurance coverage and will be liable for any shortfall or deductibles. Liability risks, employee injury, and physical damage to the building and equipment fall under their responsibility.

While traditional building contracts follow this approach, recent projects often divide work among multiple contractors under an Owner Controlled Contract. In such cases, the Principal assumes the risk and insurance responsibility, leaving contractors only with Public Liability and Employer’s Liability Insurance. Any physical damage to the Works falls on the Principal. Additionally, the Principal may consider specialist insurance if insured damage delays the project and incurs additional financing costs.

STAGE FIVE and SIX

The construction phase is where the building site comes under the control of the main Contractor, and all the construction activities take place over typically a period from 6 months to several years.

This phase continues until the Architect or Project Manager issues a Practical Completion Certificate. At that point, the risk of the site and the new buildings transfers to the Principal. On paper, it seems quite straightforward, but some critical risk exposures can arise, leading to insurance complications and serious disputes between the parties.

The Risks

When the Principal takes control of a portion of the property during construction, the Contractor’s insurance policies are suspended, leaving the new property at the sole risk of the Developer. This includes all items such as machinery, stock, and furniture, which must be separately insured while in temporary storage or partially completed structures.

In the case of building condos, if the Principal wishes to promote a display unit with furnishings, the liability risks of bringing prospective buyers to an active construction site will not be covered by the Contractor’s insurance. This poses a significant risk that requires careful attention to address.

STAGE SEVEN

This is when the Architect gives the green light that the Project has been satisfactorily completed except for any remedial works for 6 to 12 months.

The Risks

Upon the issuance of the Practical Completion, the responsibility for physical damage risks of the Project transfers to the Principal. In the event of a significant fire at this stage, the Contractor’s insurance will no longer be applicable. Therefore, it is crucial for the Principal to have permanent insurance in place, including property, liability, and business interruption coverage.

However, the Contractor’s liability insurance will remain effective during the period following their visits to the property to correct any defects or issues.

What does this mean for you?

At Tomlin Brokers, we understand that the success of any construction project relies heavily on the ability of the project owners and contractors to manage risk. To ensure the smooth running of a project, it is essential that both parties work together to identify and mitigate potential risks. Project owners should take the lead in the risk management process, by undertaking a thorough risk assessment before the project begins and developing a risk management plan that outlines the steps needed to minimize risks. Contractors, on the other hand, should work closely with project owners to understand the risks that are present and implement appropriate measures to manage them. At our brokerage, we are committed to helping our clients navigate the complexities of construction risk management and insurance so that they can focus on what they do best – building a better future for our communities.

William Tomlin

Director, Tomlin Brokers